ATO Payment Plans FAQs

Paying tax by installments could be seen as the standard quarterly BAS obligation. Otherwise, if you are not registered for BAS you would not need to lodge quarly installment. Therefore you would only complete your tax at the end of the financial year.

You can calculate and pay your tax monthly or quarterly as you decide. Then, when you complete your end of financial year tax return you would either have a smaller amount owed, or recieve money back if you have over paid.

ATO Payment plan terms generally are no longer than 2 years. However, the ATO does have some discretion for increased plan terms in exceptional circumstances. Although, the circumstances to obtain a plan in excess of two years are very few. As a result if you cannot pay a tax debt in 2 years it may be advisable to seek a business loan to pay the tax debt.

You may be able to arrange interest-free payment plans for your tax debt. However, the tax office would usually only;y allow for activity statement debt. Therefore the requirements would be:

- The activity statement debt must be paid off over 12 months.

- Secondly, your previous lodgement history and payments have been conducted well.

- Thirdly, you have only missed one payment on a plan in the last 12 months.

- Plus you have not been able to secure finance to clear your debt.

- However, you need to agree to the payment plan payment to be by direct debit for the 12 months.

- Finally, you have been able to display an ability to meet all of your tax commitments.

In some circumstances, you may be able to be released from tax debt. Though, you would need to display that paying the debt would cause you serious hardship. However, the requirements to meet the ATO policies for serious hardship would be:

- You wouldn’t be able to provide food and accommodation for your family.

- However, selling your home would not necessarily constitute an inability to provide accommodation.

You can call the Australian Tax Office directly on 132866 between the times of 8.00 am-6.00 pm, Monday to Friday.

- Firstly, ensure you prepare for your conversation.

- Above all, do not allow your payment plan for ato debt or any other ATO arrangements to lapse before calling them.

- However, If you cannot meet an agreed payment then call the ATO ahead of time.

- Finally, see the payment plan estimator from the ATO.

There are a number of different loan facilities available to pay a tax debt. Therefore, the various loan facilities may include:

- Traditional tax debt loans – where you would refinance your home loan and obtain additional money to pay the ATO debt.

- Additionally, second mortgage loans and caveat loans allow your existing home loan to remain. As a result, the new loan will be set up as an additional business loan behind your home loan.

- Business Loans secured against a vehicle; these loans can be great however they are limited to the equity available in your car.

- There is a range of business loans available, see below an overview or this business loans comparison to pay a tax debt.

- Supplier loans; as the ATO is viewed as a supplier you may obtain a supplier loan to pay the ATO debt. However, these supplier loans are best for loans that are paid off in no more than 6 months. Therefore, they may not be a suitable option if you are seeking a longer loan term.

- Unsecured business loans; these loans are not secured by the property. However, they usually have an option for a caveat or unregistered mortgage. Although, this may only be lodged in the event that the loan goes into default or payments are not made.

- Invoice factoring finance where you are able to obtain finance against unpaid invoices. However, you would need to ensure you had sufficient future revenue or working capital to meet your obligations. As you would forego the future business cash flow from that invoice.

Bad Credit Car Loans FAQs

The types of car loans for people with bad credit are similar to the major banks and car finance companies. Therefore, you can obtain the very same loan structures and features. Such as:

- Chattel Mortgage.

- Lease.

- Hire Purchase.

As your bad credit risk increases the loan terms, and residual terms would decrease. Therefore, to get the most suitable loan available to you; Loan Saver Network offers free car loan assessments.

Cars lose value quickly once you drive them off the lot, making them a depreciating asset. As a result, gap insurance is a type of top-up insurance.

Indeed, gap insurance covers the amount left on your car loan if your car is totaled in an accident. It pays the difference between what you owe and the car’s value. This can help you avoid financial loss in case of a total loss situation. For this purpose, gap insurance is an optional policy to your comprehensive car insurance.

The age of a vehicle is an important factor with all bad credit car loans. Consequently, most lenders like the car no older than ten years old at the end of the loan term. However, we have arranged great bad credit car loans against cars up to 20 years old at the end of the term. Which, consequently, means you could buy a classic, prestige car or other desirable older vehicles.

Yes, in fact, we advise obtaining a pre-approval before buying a car. Indeed, you need to ensure you are able to gain finance approval so you don’t risk losing any deposits paid. Therefore, if your finance falls through you are not as risk of losing money. As a result, we offer free loan applications so you can get a pre-approval.

Bad credit car loan terms vary depending on the severity and age of the credit impairment. Therefore, loan terms can be from 1 year up to 84 months with the most preferred loan term at 60 months.

Shorter loan term mean a higher loan repayment, therefore we find most loan terms range from 36-60 months. Indeed, the age of the car can have an effect on the loan term. As some lenders don’t like cars older than 8, 10, or 12 years at the end of the loan term.

There are not usually any upfront fees with bad credit card loans. Usually, you need to give a deposit to the seller when buying a vehicle. However, the lender may also ask you to pay a percentage of the purchase price. However, your contribution may or may not be required by the lender depending on your severity of bad credit.

If you have checked your credit report and found you have credit defaults, you can still obtain finance to buy a car. However, the interest rates are higher than the prime lender interest rates. Although, spending on how bad your credit file is, the interest rates may not be too much higher.

It is essential to understand and research your options when using finance to buy a car. Hence, see the money smart website for information on car loans.

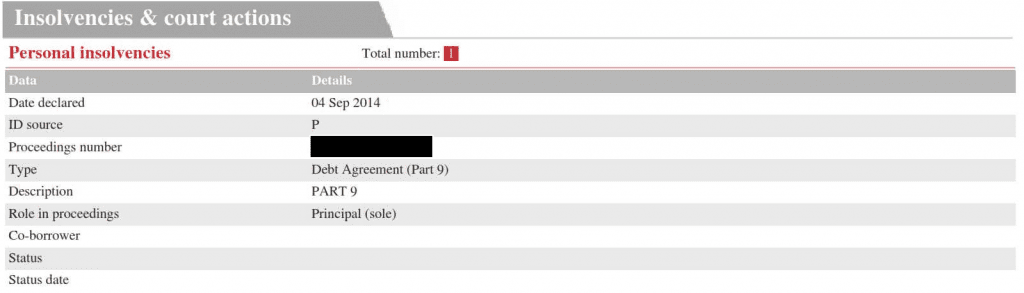

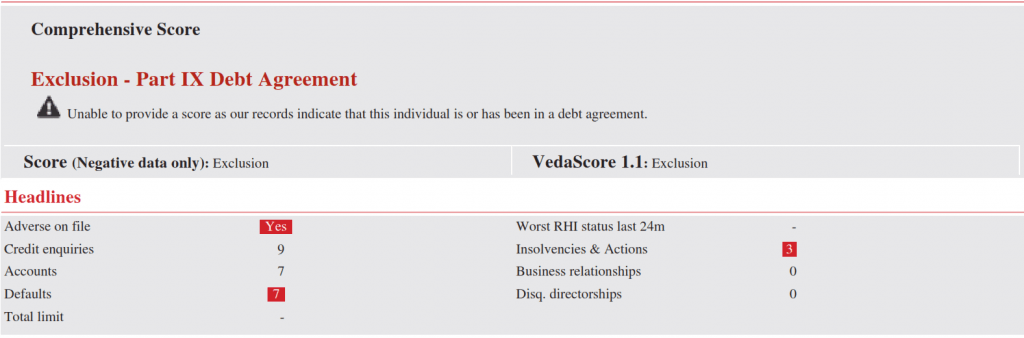

Yes, you are able to get a car loan with Part 9 Debt Agreements. However, there are some important considerations:

- Limited Lenders: While it’s possible, the pool of lenders willing to provide car loans to individuals with Part 9 Debt Agreements is restricted. You’ll need to explore specialised lenders who understand these insolvency agreements.

- Conduct Matters: The overall conduct of your debt agreement plays a crucial role. Consequently, lenders will assess how well you’ve conducted your debt agreement. Therefore, showing responsible financial behavior during the agreement period is essential.

Do you require more information on bad credit car loans? Contact Loan Saver Network on 1300 796 850 or Apply for a Loan.

Yes, you are able to obtain finance with unpaid defaults. However, the interest rates may be higher than bad credit car loans where the credit defaults are paid.

There are many forms of bad credit, such as:

- Firstly, credit defaults.

- Secondly, your credit score is reduced by applying for too many loans.

- Thirdly, court judgements and court writs.

- Certainly, discharged bankruptcies are accepted.

- However, finance is not available while you are under full bankruptcy.

- Finally, you are able to get a bad credit car loan with a current part 9 debt agreement.

Generally, the lenders like to see the credit issues older than six months old, and also paid. However, we have seen loan approvals for people with very bad credit.

Business Loans FAQs

Qualifying for a business loan requires criteria than meets a lenders guidelines however, each lender has different criteria to ensure your meet the lenders requirements. These requirements are based on the use of money, the ability to repay the money borrowed by income or exit strategy, and also the ability for the lender to have money returned in the event of a loan default using a property sale.

The interest rate for a small business loan varies based on the security used for the business loan, the type of security, credit risk and income. Generally, the higher risk business loans attract higher interest rates however traditional commercial loans can start from interest rates under 9% while more specialised business loan rates can be over 10%.

There are different types of business loans with each type of loan requiring different documentation. The documentation requirements may be required are Identification to confirm who you are, business activity statements, ABN (Australia Business Number), possibly tax portal statements, trust deed, and income financials. However, some lenders don’t require income financials, while others require up to 3 years or even cashflow projections.

Yes you can still get a business loan with Bad credit. However, some lenders don’t allow credit issues while other accept minor credit issues and the more specialist business loans can accept heavy credit issues with explanation.

The maximum unsecured amount you can borrow is around $500,000 and depends on your business turnover. However, the maximum amount can be higher when property security is available. As such the loan amount for secured business loans can be up to $1,500,000 or higher.

Yes, there are unsecured business loans which rely more on the business turnover in assessing the ability to repay the loan.

The time from application submission to approval is dependant on the lender and the type of loan. However, some main stream lenders can take up to 8 weeks while some specialist loans can be approved and settled within a few days.

Repayment terms for business loans can range depending on the type of facility, and also the business requirement. As a result, repayments can range from weekly payments and monthly repayments to a prepaid interest facility for a set term. As a result, pre-paid interest is paid at the start of the loan and therefore have no ongoing repayments.

Prepaid interest facilities are facilities where they are generally paid back using the sale of property or other form of asset. However, they are also commonly used where a business has limited current income to support a traditional loan and needs time to establish income to meet payments.

Yes and no, generally there is 3 month minimum interest payable. However, each loan facility is different and can be higher or lower depending on the facility and lender. However, there are some line of credit facilities where you can access funds and repay the balance almost immediately without penalty or a fixed minimum interest amount payable.

A business loan is a fixed term loan and payment. Therefore, the funds you require are fully paid to you at establishment of the loan. Whereas, a line of credit has a set credit limit and the funds can be drawn up and paid down as you require. Therefore, the interest you pay is based on the drawn down amount of the facility. However, line of credit facilities usually has a higher interest rate than a term facility. As a result, you should ensure the features suit your requirements as they do generally have a higher cost.

Caveat Loans FAQs

- Initially, we have a free over the phone consultation to discuss your options & how to apply for a caveat loan.

- Secondly, we obtain business and security property information for the initial loan offer.

- Thirdly, the lender issues a letter of offer which is completed and returned.

- Then, solicitors prepare loan documents.

- Finally, your loan settlement and your funds are available.

The process from initial enquiry to funds in the bank can be less than 24 hours.

Exit strategy refers to paying the borrowed funds back to the lender. Therefore, finalising a loan using an exit strategy allows paying back the private finance from an expected lump sum payment. Consequently, this could be from the sale of an asset; or the receipt of a lump sum via:

- Firstly, selling a property asset or another asset.

- Secondly, mortgage refinances where the business loan is repaid by refinancing your principal mortgage and the caveat loan.

- Also, repay the loan balance from the sale of business stock. Such as buying and importing goods for sale.

- Otherwise, closed from funds obtained from a business investment.

- Finally, repay the loan funds from the sale of a business.

Furthermore, with a suitable exit strategy, the loan payments can be more flexible than with traditional finance. Therefore, payments can be made monthly or paid upfront when the caveat loans settle.

Secured Short Term Loan terms typically range from one month to twenty four months; however, a six-month loan term is typical. Although, longer loan terms are available depending on the loan purpose.

Secured caveat loans are used mainly for business purposes. Therefore, objectives such as paying bad debt, tax debt or unusual working capital purposes. Otherwise, obtaining funds to invest in business growth, such as funds for marketing.

Above all, short term loans can allow access to money fast. Otherwise, where there is difficulty in obtaining funds through traditional lenders. As a result, registered caveat loans could include purposes such as:

- Initially, paying tax debts.

- Secondly, using a bridging loan to buy a business.

- Thirdly, buying stock or equipment for a start-up business.

- Also, buying commercial real estate such as warehouses, offices, retail premises.

- Plus, purchase residential property in some circumstances.

- Indeed, you can refinance business loans into a new entity. Therefore, business loans such as business overdrafts, business loans or supplier debts.

- Also, closing a business and paying liquidation expenses.

- Indeed, bad credit caveat loans are also available.

- Finally, only for business use with a clear exit strategy.

Related information: See our Tax Debt Loans page for information about Tax Debt Loans and ATO solutions.

Most caveat loans use a registered caveat for speed then convert to a 2nd mortgage. As such, they are allowing the lender the authority to sell your property in the event of a default.

Getting approval from the First Mortgagee to register a 2nd mortgage can take time. Consequently, you can reduce settlement speed by using a caveat. Therefore, you have access to funding while the lender lodges the second mortgage.

In summary, a registered caveat allows access to funding fast (24-72 hours).

A caveat loan is a secured business loan using a registered caveat against real estate as security. Hence, the difference between a caveat loan and a mortgaged loan is the type of security registration. As such:

- Firstly, a caveat expresses only a financial interest in the property with minimal recovery powers. Therefore, a caveat does not give the ability to sell the property and recover monies owed.

- Secondly, a first or second mortgage gives the lender recovery powers in the event of a default.

Yes, bad credit caveat loans are available. As a result, a wide range of credit issues are acceptable such as:

- Credit defaults.

- Also court judgments and court writs.

- Plus business wind up notations.

- Discharged bankruptcy including Part 9 debt agreements.

However, not all lenders will accept all credit issues. Consequently, prior to a formal application you should confirm a lender will accept your credit issues.

Therefore, if you are unsure if your issues are acceptable. Otherwise, you have been declined; you should seek professional advice for your loan assessment.

Contact Loan Saver Network on 1300 796 850.

Debt Consolidation FAQs

One of the disadvantages of a debt consolidation loan can be that the loan term is extended further. Hence you pay more interest. Also, especially considering car loans being consolidated into a home loan you could be paying the car loan even after selling the vehicle. However, each case needs to be assessed on their merits. As if you are unable to meet your loan payments you may require a repayment reduction to manage your budget. As a result, in this case a debt consolidation may be a suitable option. However, all the pros and cons needs to be considered.

Yes, however if a business second mortgage the debts to be paid must be >50% business debts. Although, there are consumer second mortgages and caveat loans available with the exit strategy being a property sale.

Credit Cards used for general expenses

More and more often these days, we are seeing clients needing credit card debt consolidation. Certainly, credit cards are useful however, they can also be a problem. As a matter of fact, we see an over-dependence on credit cards to pay for high household expenditure.

New lending policies with credit card debt

New lending policies are being released weekly. As such, one of the recent changes is related to credit card debt and credit card payments.

Previous payment calculations were calculated at 2.5-3% of the outstanding balance. Accordingly, this amount will increase to allow the credit card to be paid off within three years. Consequently, reducing your borrowing power on bad credit home loans finance.

Paying off credit card debt

There are some simple ways to pay off credit card

- Initially, increasing payments above the minimum required to allow paying off within six months.

- Secondly, funds transfer to a 0% interest credit card. Then, 100% of your payments are applied to reduce the balance.

- Thirdly, consolidate credit card debt into a lower interest loan with a 1, 2, 3 or even 4 or 5-year terms.

- Finally, debt consolidation home loan to pay the credit card debt.

How do I know my credit cards need consolidation?

- Firstly, credit card balances are consistently above the card limit.

- Secondly, you can see you will be missing payments shortly.

- Your credit balances are increasing even if you are making payments.

- Also, you are using credit cards to top up your monthly budget.

- Finally, your account is in collections.

If you experience any of these issues, please call Loan Saver on 1300 796 850. In this situation, we will advise if a debt consolidation home loan is the best solution for you

As mentioned above, the term debt consolidation has been used and misused as a sales process by unscrupulous bankruptcy operators. There are many other misconceptions related to debt consolidation to, such as the below.

Common Debt Consolidation Misconceptions

- Misconception 1 is where a Debt Consolidation Loan is a Part 9 Debt Agreement; or a different form of bankruptcy. However, debt consolidation is not a part 9 debt agreement.

- Misconception 2 is that Debt Consolidation always lowers your repayments. Even though this is the goal, not all debt consolidation will reduce your monthly repayments. As such, your assessment will advise your expected payments.

- Misconception 3 is that Mortgage Debt Consolidation always lowers your interest payable which is not correct. For example, refinancing a 5-year personal loan to a 30-year home loan term may reduce your monthly payments. Consequently, the interest paid over the 30-year term may end up being higher.

Yes, there are various bad credit debt consolidation loans that allow credit defaults. As such, you can refinance home loans, personal loans and debts in various states of arrears and default. Therefore, debt consolidation home loans can be obtained to refinance:

- Certainly, credit defaults

- Secondly, court judgements

- Thirdly, Poor Credit Score through too many loan enquiries, or payday loan applications.

- Also, Home Loan Arrears.

- Discharged bankruptcy

- Undischarged bankruptcy (in some circumstances)

- Also, company liquidation

- Finally, business wind up proceedings caused by tax debt.

If you can see any of the above conditions occurring, taking action earlier could assist in preventing further credit defaults. Given these points, contact us for professional debt advice today on 1300 796 850.

Bad credit and debt can be caused by several reasons. Consequently, there are many solutions for bad debt including debt consolidation. Consequently, an assessment of your circumstances needs to be conducted to identify the cause and solutions available.

The major issue causing bad credit

- Firstly, the loss of income results in a reduced capacity to make payments to debts. Therefore, there would several objectives to achieve an effective solution:

- Firstly, a reduction in the overall payments may fix the problem. As a result by seeking a competitive low-interest rate bad credit home loan.

- However, lenders serviceability will need to be confirmed to ensure you would meet their income requirements.

- Certainly, debt consolidation may protect your credit file and avoid escalation to bad credit.

Other issues causing bad credit

- Secondly, personal or family sickness is a complicated issue where you may be more suited to applying for hardship. However, if the issues are in the past and you are left with the debt you may qualify for debt consolidation to clear the debt.

- Expenditure – expenditure and spending were reviewed in the royal commission into the banking industry. As a result, all consumer loans are assessed for expenditure. therefore, a high expenditure would not eliminate you from obtaining finance. However, your monthly spend would be included in your borrowing capacity assessment.

- Gambling and mental illness can cause debt problems. Consequently, the only way to obtain finance to consolidate gambling debt is to show no gambling for a minimum of 3 months. therefore, without time to show no gambling, there is no ability to obtain finance. However, gambling is viewed as entertainment. Therefore, if your expenditure is within your income limits then you may still obtain finance.

- Divorce or family issues; Divorce is one of the most traumatic events a family can experience. Consequently, the effects can be financially devastating for all parties.Divorce considerations:

- Firstly, divorce is very expensive. For the same reason, legal fees can amount to tens of thousands of dollars. As a result, debt consolidation can be used to finalise legal bills.

- Secondly, divorce can take a long time to negotiate with an ex-partner. Consequently, a divorce settlement may mean debt consolidation is not the immediate solution. However, we are happy to discuss your situation as we have assisted many couples through their change in marital status.

- There is a range of bad credit solutions for each issue. Not all bad credit debt issues require a debt consolidation home loan solution.

Debt Consolidation must meet government and lender guidelines for responsible lending. Therefore, when applying for a home loan with bad credit your requirements must meet government and lender compliance.

The intention of debt consolidation is usually to reduce payments and resolve debt problems. Consequently, below is a list of information to consider when applying for bad credit home loans.

What to think about with bad credit home loans refinance?

- Firstly, are any of your debts in arrears or default? Consequently, we find bad debt can escalate quickly past the arrears or credit default. Consequently, arrears and defaults could easily result in a court judgement and asset seizure.

- Secondly, have debts been referred to credit reporting agencies?

- Thirdly, are your debts paid on time and when they are due? For the most part, are the loan and creditor payments late?

- Also, what is the underlying cause of payment issues?

- Plus, what debts will be paid and also what debts will remain with continuing payments?

- Finally, will the problems be resolved by paying out good or bad debts?

Each debt consolidation home loan case is different and requires individual assessment. Hence, Loan Saver Network is a professional mortgage broker working for you. In summary, we can assist to ensure your debt consolidation mortgage meets banking and government compliance?

See debt consolidation article on what to do if you are struggling with debt and seeking a bad credit debt consolidation loan.

Lenders’ risk reduces when property security secures the debt consolidation loan. Given that, along with a reduction in risk the loan interest rate and fees can also reduce. Consequently, lowering a loan repayment can be achieved by:

- Initially, reduction in overall interest rate. As such, existing debts such as credit cards, unsecured personal loans and some car loans can have high-interest rates.

- Similarly, extend the loan term of the debts. For example, you are refinancing a 5-year personal loan into a 30-year bad credit home loan term. In this situation, extending the personal loan term from 5 to 30 years.

Reducing the overall interest rate is a great outcome. However, extending the loan term does attract additional interest over the loan term. Therefore, the benefit to you must be greater than the cost. Such as, preventing credit defaults, or a reduction in outgoings allowing a manageable budget surplus.

Benefit in reducing your bad credit risk

Along with potential repayment reductions, there are also other benefits to your financial situation to consider. As such, these benefits are reductions in financial risk to you.

- Firstly, pay off the arrears or defaulted debt can prevent repossession of assets.

- Secondly, reducing the further impact on your credit file.

- Finally, simplify multiple debt repayments and manage your cash flow better. Hence, if you have no monthly surplus, a small mishap such as illness can quickly escalate to default. Consequently, consolidating your debts to reduce payments can assist in reducing this risk.

Contact Loan Saver today for a free bad credit home loans assessment, and start the road to recovery.

Various debt solutions to fix debt or bad credit problems

- Firstly, Debt Consolidation can be an effective solution to reduce overall payments.

- Secondly, Debt negotiation is effective to reduce the amount owed on your debt balances.

- Thirdly, informal payment arrangements; where reduced payments are negotiated with creditors.

- Certainly, Part 9 debt agreements can be a form of bad credit that can be consolidated.

- Also, Part 10 Insolvency where you don’t fit the guidelines for a Part 9 debt agreement.

- Certainly, a full bankruptcy to resolve all your debt. However, a full bankruptcy can involve the sale of your assets to pay your creditors.

- Finally, business liquidation or business wind up.

Any of the above debt solutions could be most appropriate for you. However, professional assessment and advice would be advisable as each solution has there own benefits, problems and costs. In essence, no client has the same story or issue, so all solutions need to be considered. Being that, there is no one size fit all solution where a debt consolidation loan will solve all debt issues.

Mortgage Arrears FAQs

Default interest rates come into play when you have missed payments and is declared as a mortgage in default. Here are the key points you need to know:

- Charged When in Default: All lenders impose a default interest rate when your home loan is in default. This rate is typically higher than (or additional to) your regular interest rate.

- Loan Contract Details: Your loan contract specifies the exact amount you’ll be charged for default interest. Indeed, keep an eye on this information—it’s crucial.

- Additional Mortgage Arrears Rate: In addition to your regular interest rate, there’s an extra mortgage arrears rate, usually ranging between 3% to 5%. As such, this additional rate is applied on top of your normal interest.

- Varied Approaches by Lenders:

- Some lenders apply the default rate only to the arrears amount.

- Others calculate the default rate based on the entire loan amount owed.

- Timely Payments Matter: To avoid default interest, ensure you make payments on time. Indeed, consistent, punctual payments are essential.

- Example Scenario:

- Let’s say your regular interest rate is 4%.

- If you fall into default, you might face an addiitonal 5% which totals a 9% default interest rate.

Remember, understanding your loan terms and staying informed about your obligations is crucial for managing your mortgage effectively.

Do you need help with mortgage arrears? Contact Loan Saver Network on 1300 796 850 or Apply for a Loan.

Lenders classify a mortgage in arrears as bad credit. Therefore, by the nature of the mortgage in arrears refinance, they will accept other bad credit. However, as the severity of the bad credit increases so too does the interest rate; and the reduction in the Loan Value Ratio (LVR).

Types of acceptable bad credit are:

- Firstly, low credit scores may prevent traditional finance; however, non-conforming lenders accept low scores.

- Secondly, credit defaults and court judgements can be acceptable. However, older credit file listings have less effect on the loan interest rate and LVR.

- In some cases, discharged bankruptcy would be acceptable. However, older bankruptcies would provide better loan pricing.

- Also, where you were a director of a company forced into liquidation. Indeed, bad debt would have caused the company closure.

- Finally, being behind on your council land rates can prevent traditional bank approvals. Therefore, council land rates arrears are bad debt arrears.

Keep in mind, as the severity of the bad credit increases so too is the reduction in the lenders’ appetite for risk. Consequently, a specialist mortgage advisor can assist with your mortgage in arrears; and bad credit advice for your loan application.

Consequently, common reasons for mortgage arrears leading to eviction are:

Debt Related Issues

- Firstly, a change in the debt level, such as getting a car loan.

Income Related Issues

- Secondly, reduced income, such as having a baby and taking maternity leave. Hence, there is an upset to financial stability.

- Thirdly, income issues related to reduced economic conditions and an increase in the unemployment rate. Consequently, we see this with the Coronavirus outbreak.

- Also, the end of an employment contract can mean income stops.

Environmental or Economic Issues

- Thirdly, a decreased housing market and real estate values. As such, the mortgage arrears could relate to an economic downturn resulting in no equity and inability to consolidate debt.

- Moreover, divorce and family break up can cause a significant impact on financial stability.

Health Issues

- Finally, mental health, gambling and substance abuse issues that reduce the capacity to maintain mortgage payments.

- Then, medical reasons such as cancer, death of a family member, sickness of a child or income earner. Also, a partners health issue could result in one income loss. Whereas a child’s health issues can result in the loss of both incomes.

The Complexity of Mortgage in Arrears Issues

Quite often, the problems that have caused arrears are complex. For instance:

- Initially, starting with gambling and the associated debt issues.

- However, the debt issues, caused by gambling then result in divorce.

- Finally, divorce and other problems cause mortgage payments to fall behind.

There is a range of refinancing and hardship solutions available to assist. Importantly, if you are behind on your home loan payments, you should seek financial counselling advice. Otherwise, employ the services of a specialist mortgage broker to assist in refinancing your mortgage in arrears.

There are several other solutions to consider when you are behind on your home loan repayments. However, you may not be able to capitalise you mortgage arrears with a refinance because of government or lender policies. As a result, see the list of alternative mortgage arrears solutions available to you below:

Mortgage Hardship

Each lender has home loan hardship policies to help bad financial situations for all consumer loans. As a result, asking for hardship to assist with your arrears may be possible. However, there are many different mortgage hardship structures for your financial problems:

- Firstly, increasing your home loan payments.

- Secondly, pausing your mortgage repayments altogether and making up your repayments with a lump sum.

- Thirdly, stopping your repayments for some time; then making higher than the standard repayments.

- Also, adding your home loan arrears to the end of the loan term; meaning you don’t have to pay the arrears today.

- Finally, allowing for no payments until you sell your home.

It is vital to understand the hardship you are asking for; and also what is approved. Consequently, a wrong hardship agreement could result in prolonging a property sale, or a home loan refinance. However, you may also apply for a hardship variation.

Payment Plans

Secondly, payment plans are usually part of a hardship plan. As a result, a hardship arrangement should allow you to pay your mortgage arrears over an extended time. However, the collection process can recommence if you miss a payment or falter on your hardship requirements.

Mortgage Payment Insurance

Have you got a mortgage payment insurance policy on your home loan? Importantly, mortgage payment insurance protects your home loan payments. As a result, the insurer may pay your mortgage payment while you are having trouble. Certainly, mortgage payment insurance is not “lenders mortgage insurance (LMI)” which only protects the lender in the event of your default.

Ombudsman Complaint

Are you having trouble obtaining a payment plan? Otherwise, have you been rejected for hardship? As a result, an AFCA complaint may help with your hardship request. However, once your lender has obtained eviction orders (legal/court action), an ombudsman complaint will be rejected by AFCA.

Release of Superannuation

You may release your superannuation payments to bring your mortgage arrears up to date. However, this is only available for owner-occupied properties. Also, the release of superannuation must stop the lenders’ eviction process and pay back the entire home loan arrears.

As a result, you need to have sufficient superannuation. Consequently, the superannuation release will need to pay your arrears and the super tax fully. Otherwise, the eviction process will continue.

Financial Counsellors

Financial counsellors can help when you have financial difficulties. Indeed, a financial counsellor can help negotiate:

- Repayment arrangements to repay the arrears debt.

- Certainly, hardship applications with your lender.

- Also, a release of superannuation to clear the arrears.

- Plus connecting you to other government services that may assist.

- In some circumstances, investigate and negotiate with insurance companies.

We highly recommend talking to a specialist mortgage advisor about your loan options. Hence, tighter lending standards means greater difficulty in obtaining approvals; even if you have a good credit rating. Call Loan Saver Network on 1300 796 850 to discuss your options. Therefore, you may qualify for a mortgage refinance, financial hardship or one of the other solutions noted above.

Part 9 Debt Agreements FAQs

- Firstly, part 9 debt agreements are suitable if you are on a low income; and fit within the DA thresholds.

- Secondly, full bankruptcy is most suitable when there is no income, or limited assets that a trustee can sell.

- Thirdly, home loan debt consolidation can be suitable with sufficient equity and income. As a result, it can be used to pay out both good and bad debt, including personal or business tax debt.

- Also, unsecured personal loan debt consolidation usually has minimal benefits. The lender policies are very strict because the loans are unsecured. Plus, can result in small loan amounts & high-interest rates.

- Finally, informal payment agreements are usually established to reduce payments. However, payment terms can be quite long, and you may find you have the same amount of debt after many years.

Various parties can access information about your insolvency, which is kept on a number of databases.

- Firstly, credit reporting agencies record all forms of bankruptcy on your credit file.

- However, the National Personal Insolvency Index (NPII) also holds all forms of bankruptcy. Recorded information on the NPII is held longer than on your credit file.

- Finally, lenders will look at your credit file when you apply for credit. As such, Part 9 may prevent you from getting further finance. Although, not all lenders check for long term insolvencies.

Applying for a Part 9 Debt Agreement is an act of bankruptcy. Another key point is if your creditors reject your agreement, you can apply to the court to make you bankrupt.

A debt agreement is not a debt consolidation loan. Furthermore, Part 9 refers to the Part 9 clause under the bankruptcy act of 1966. As such, it is registered on the national personal insolvency index (n.p.i.i) as a form of bankruptcy. Therefore, if you are under an insolvency agreement, it will appear on your credit file under bankruptcy.

Keep in mind; a part ix debt agreement is not debt consolidation or full bankruptcy. However, simply applying for a part ix debt agreement is an act of bankruptcy. As such, if your debt agreement is rejected, you may apply to become bankrupt.

Debt consolidation mortgage or loan is where you obtain finance to combine your debts into a single loan payment.

Debt Agreement Administrators are professional debt negotiators who will negotiate with creditors. Consequently, they will also work with you to obtain a budget and manage your debt agreement. However, they also negotiate with your creditors to accept your proposal.

Simply applying for a Debt Agreement is an act of bankruptcy. Hence, it is important to obtain advice to ensure a debt agreement is the most suitable solution. Further-more, debt agreement administrators are professional debt negotiators. Similarly, they can advise you of the potential for your debt agreement proposal to be accepted by your creditors.

Important to realise, is that a debt agreement administrator charge fees, and in some instances, they can be quite high. By and large, most fees are added into the Debt Agreement (DA).. However, obtain fee quotes if you are considering a part 9 debt agreement

A range of debts cannot be included under a Part IX debt agreement. Specifically, confirm with your creditor if insolvency can be used to settle your debts. However, some of these debts are:

- Firstly, any secured loans cannot be included under a debt agreement. As such, these may include car loans, home loans, and any caveat debt.

- As well as fines, penalties and court-ordered payments cannot be included.

- Certainly, child support cannot be included and you will still owe it.

- Also, study loans such as HECS or HELP Loans and a debt is owed to the government.

- Additionally, victims of crime debt & money owed as a result of a crime.

- Likewise, debts incurred by fraud are not required to be included.

- Finally, debts incurred after Australian financial security authority accept your proposal.

Related pages: Money Smart Website: What debts does a debt agreement cover?

One option to fix debt problems could be an insolvency. For instance, two forms of insolvency include part iv debt agreements and part x insolvency agreements. However, Part 9 and Part 10 differ in the level of bankruptcy. In other words, the policies and threshold will highlight which insolvency is most suitable.

Part 10 insolvency agreements are intended for when you are unable to make payments toward the debt. Furthermore, you don’t meet the financial thresholds for a debt agreement. In particular, debt agreements are where you can meet the income and other limits, and can make payments.

Part 10 usually sells assets to pay creditors, offering limited refinance options. In brief, we will be providing information on debt agreements and the finance options available for you.

Most personal unsecured debts can be included under a debt agreement. Therefore, debts such as:

- Personal loans, credit cards and store cards.

- Additionally, payday loans and loans <$2000 can be included. As such, these loans typically are loans repaid within one year or less.

- Plus, overdrawn bank accounts and unsecured overdrafts.

- Likewise, you can include unpaid rent as a creditor to be put under a debt agreement.

- Significantly, medical, accounting and legal fees as debt issues can result from these matters.

- Finally, Phone, internet, gas and electricity bills can also be included in a debt agreement.

Debt Agreement Pro’s

- Certainly, debt agreements are an alternative to full bankruptcy.

- Above all, your unsecured debts’ interest is frozen. Only the principal plus establishment fees are paid.

- In addition, your creditors cannot pursue you legally for recovery of the money owed.

- Above all, you can apply for multiple household debt agreements to reduce the overall household debt.

- Finally, if you have property equity within the equity threshold, you can retain your property.

Debt Agreement Cons

- Firstly, they will affect your ability to get credit.

- Above all, a debt agreement does not include secured assets. Therefore, you still have the obligation to make those payments. As such, if you cannot make the payments, the lender can repossess your assets.

- However, if you run a business, you need to inform your clients that you are under a part 9 debt agreement.

- Keep in mind; some employment industries restrict employment for people under debt agreements.

- Finally, if you are unable to keep the payments on a Part IX debt agreement, you may be made bankrupt. Since simply applying for a debt agreement is an act of bankruptcy. As such, your creditors can apply to make you bankrupt.

See information about how to consolidate your part 9 debt agreement.

Otherwise, contact Loan Saver Network for more information at 1300 796 850.

A debt agreement can avoid the full effects of bankruptcy. Nevertheless, entering into a Debt Agreements has serious consequences as with any insolvency.

Part 9 Debt Agreement benefits

- For the most part, an insolvency agreement can assist you in gaining control of your debts.

- Certainly, harassing phone calls will stop; as the debt agreement administrator manages your debts.

- Furthermore, you will repay what you can afford based on a budget you submit for assessment.

- Subsequently, will have a negative effect on your credit file and credit score.

- Regardless, you may not be able to obtain future credit for up to 7 years

Is a Part IX debt agreement suitable for you?

- Firstly, are you having issues making your loan repayments on time?

- Secondly, you haven’t been in bankruptcy in the previous ten years?

- Thirdly, you have unsecured debts below the set amount of $116,662 (as of 29th Jan 2020).

- Finally, your after-tax income is less than the threshold amount of $87,496.50 (as of 29th Jan 2020).

If you answered yes to these questions, then a debt agreement may be suitable for you. However, Loan Saver recommend speaking to a financial counsellor to advise the most suitable solution.

Part IX refers to part 9 under the bankruptcy act of 1966. Consequently, a debt agreement is a binding agreement between yourself and your creditors. Hence, the agreement is to repay the unsecured debts & avoid the need for full bankruptcy. Furthermore, debt agreements are intended for:

- Firstly, low-income earners or fit within the income threshold.

- Secondly, they are also struggling to pay their debts and fit within the debt threshold.

- Finally, individuals committed to paying back their debt; therefore don’t want a full bankruptcy.

Considering debt agreements should not be taken lightly, as they represent a serious step to resolve your debt. In particular, you should obtain independent advice regarding debt agreements. With this in mind, you can make contact with a financial counsellor or legal service to obtain advice. What’s more, see below links to the Money Smart Government website for information.

The government has strict policies and thresholds with regard to debt agreements. Hence, there are thresholds for:

- Firstly, your individual income.

- Then, the debt amount included under the agreement.

- Thirdly, the assessed net property equity.

- Certainly, there are many other policies related to your debt agreement proposals.

Loan Saver Network highly recommends speaking to a financial counsellor if you are considering a part IX debt agreement.

Applying for a Debt agreement is considered an act of bankruptcy. Therefore, if your debt agreement is terminated, you can then apply to be made bankrupt. Certainly, a creditor can apply to a court to make you bankrupt As a result, bankruptcy may result in:

- Certainly, the sale of your assets to settle your debts.

- Also, terminating the debt agreement will re-instate any waived interest payments. Hence, you would need to repay your debts in full, including interest.

- Finally, lenders would apply high-risk pricing to any finance, resulting in higher interest rates.

For advice about your Part 9 Debt Agreement call Loan Saver Network today on 1300 796 850.

Most people in insolvency find relief in their debt agreement. Generally, the most challenging time was managing the debt before Part 9. However, now that time has passed, you are seeking finance options to better your situation. therefore, you are in a debt agreement and looking for information about your finance options. As a result, see below the finance available while in a debt agreement.

- First of all, Yes, you can refinance your home & combine your debt agreement. However, you must pay and discharge the Part 9 debt agreement at settlement.

- Secondly, Yes, you can buy a house while under a debt agreement. However, you would need to pay out your debt agreement at settlement. As a result, the combination of paying the debt agreement plus lender and government fees may prevent you from buying.

- Furthermore, Yes, you can obtain finance to buy a car and retain your debt agreement. However, your debt agreement would need to be up to date with good payment history.

- Finally, you cannot pay out a debt agreement with an unsecured personal loan.

Second Mortgages FAQs

Second mortgages are a type of security registration that is placed behind another registered mortgage (1st mortgage) usually by another lender. For instance, a lender such as CBA , ANZ or any lender may register a mortgage to secure a loan they provide. Then, if a subsequent loan is required by you a lender may register a mortgage behind the existing 1st mortgage to secure the additional funds they offer.

Second mortgage loans are generally for business purposes. However, are also suited for limited consumer purposes where there is a property sale. The main requirement in each case is sufficient equity with a maximum loan ratio at 70%-80% depending on the lender and security type & location. However, if the loan is a business loan, then the funds must be used for business purpose.

Second mortgage loans are generally used for business purposes. However, are also suited for limited consumer purposes where there the loan is paid back by selling the security property. The main requirement in each case is sufficient equity with a maximum loan ratio at 70%-80% depending on the lender, security type & location. However, if the loan is a business loan, then the funds must be used for business purpose.

Second mortgage rates start at around 13.95% pa. However, depending on the lender, the assesed risk, your credit rating and your type of security property the interest rates can be higher. Generally, lower interest rates can be obtained using a residential security property in a main city. Also, if more lenders have interest when you show a solid exit strategy.

Yes, however if a business second mortgage the debts to be paid must be >50% business debts. Although, there are consumer second mortgages and caveat loans available with the exit strategy being a property sale.

The required equity for obtaining a second mortgage depends on the type of security involved. Generally, the following guidelines apply:

- Residential Properties:

- Equity Range: Typically, lenders prefer homeowners to have 20% to 30% equity in their residential properties.

- Loan Ratio: You can often borrow up to 70% to 80% of your home’s value (LVR), less your existing first mortgage loan.

- Vacant Land and Commercial Property:

- More Equity Required: If you’re seeking a second mortgage for vacant land or commercial property, more equity is usually required due to the perceived risk and reduced saleability associated with these types of assets. Therefore you could expect 55%-70% LVR against your security depending on the type of asset and location.

A second mortgage loan allows you to retain your existing first mortgage lender while accessing additional funds provided by the second mortgage lender. On the other hand, refinancing involves paying off your current first mortgage lender and releasing the security. In a refinance scenario, a new mortgage is established to secure a fresh loan facility.

Key differences:

- Purpose: Provides additional funds without replacing your existing mortgage.

- Lenders: You keep your original first mortgage lender (Lender A) and obtain additional funds from a second mortgage lender (Lender B).

- Security: Both Lender A and Lender B register mortgage security on your property title.

- Advantages: Flexibility, reduced income verification, fast settlementy times, capitalisation of payments.

- Considerations: Risk of default and set up costs.

Refinancing:

-

- Purpose: Replaces your current mortgage with a new one.

- Lenders: Your original first mortgage lender (Lender A) is paid off, and a new lender (Lender B) takes over your loan.

- Security: Refinancing releases the mortgage security held by Lender A. Then, Lender B registeres a new mortgage security.

- Advantages: Lower interest rates, longer term solution, lower fees.

- Considerations: Income verification, timing to recieve monies, acceptable loan purpose for the lender.

If you have questions related to second mortgage loans and the suitability for your situation. Contact Loan Saver Network on 1300 796 850 or Apply for a Loan.

Firstly, when considering credit applications, it’s important to recognize that all credit inquiries impact your credit file. This applies to second mortgages as well. Therefore, to maintain a healthy credit score, approach credit applications strategically and avoid unnecessary loan applications that access your credit history

Secondly, it’s important to understand that second mortgage interest rates tend to be higher than those for first mortgages. Certianly, as the loans are generally short term and the lender and investor returns are more demanding. However, lenders also see the second mortgages as riskier, which influences the rate.

Thirdly, lenders may have less stringent income verification requirements for second mortgages. However, applicants should exercise caution and avoid overestimating their repayment capacity.

A second mortgage sits behind a mortgage registered against the title of your property. Hence, the first mortgage is placed there by your bank. Consequently, second mortgage finance allows access to equity without the need to refinance the first mortgage.

As the first and second mortgage loans are separate facilities’; there are still equity limitations. Let’s look at this example:

- Home Value – $500 000

- Current Home Loan – $100 000

- Available Equity = $400,000.

Given that, private finance can access a portion of the $400,000 up to their maximum allowable LVR.

Short term business loans such as caveat loans and second mortgage loans are higher risk for a lender. As such, this is a result of minimal income and other credit requirements. Consequently, to reduce lender risk, lenders require more equity.

Private lenders usually require 25% equity; or a maximum 75% LVR inclusive of closing costs, fees and capitalised interest. In some cases, you may obtain capitalised loans payments. For the same reason, risk reduction would require a strong exit strategy along with your ability to meet payments.

The lending criteria for private lenders vary a lot with banking finance. By comparison, businesses can enjoy the simplicity of the second mortgage loan lending criteria. See below some lending criteria for second mortgage business finance:

- Firstly, the loan must be for the majority business purpose.

- Consequently, greater than 50% of the second mortgage finance must be for business purpose.

- Secondly, minimal or no income verification is required for most loans.

- Thirdly, short term and start-up business ventures finance with one day ABN registration.

- Fourthly, the second mortgage loans are useful when funds are needed urgently.

- In particular, debt consolidation is available for tax debt and other business debt.

- Importantly, some private lenders don’t require property valuations. Therefore, online or real estate agent valuations may be acceptable.

- Also, credit defaults, court judgements, and various insolvency can be accepted.

- In particular, fixed interest is payable for the loan term. However, some lenders offer variable rates.

- Certainly, LVR’s available are generally to 80% inclusive of capitalising interest and loan set up costs.

- Otherwise, if the tax debt is a personal debt, then you may need to refinance a home loan to pay the tax debt.

- Finally, 2nd mortgage loans or caveat loans can be used to pay a business debt and mortgages in arrears or land rates arrears.

Related Information on second mortgages.

The main difference between the two private lending facilities is the security type. Certainly one is a second mortgage and the other being a caveat. Otherwise, they are very similar, except for the speed to access funds.

Consequently, the speed of caveat loans is much faster as you don’t need to obtain approval from the first mortgagee. Therefore, see the comparison below between the two private facilities.

A second mortgage needs to be approved by the first mortgagee. As a result, loan settlements can take three weeks or more. However, while waiting for the second mortgage to be approved by the first mortgagee, you may still have access to the funds.

Caveat security can be registered while waiting for the second mortgage to be registered. In that case, a loan settlement of 24 – 48 hours would be possible

Conventional banks actively search for self-employed borrowers with tax debt as they don’t want any borrowers with tax debt as it highlights a business income and mortgage with higher risk. By and large, second mortgages and specialist loans can pay a tax debt. Plus are useful for fast loan settlements when an ato court judgement or bankruptcy is pending.

- Firstly, If speed is critical, then caveat loans are a preferred option.

- Also, Second mortgage finance is preferred if traditional lending policies would not allow access to funds.

- Finally, a first mortgage refinance is usually the preferred way of paying tax debt when time is available.

Loan Saver Network offers advice about second mortgage loans and private lenders to solve business debts. As such, contact our team for a free consultation on 1300 796 850.

- In the first instance, you need to pay creditors and stop a business wind up.

- Then, business restructuring and requiring finance. Hence, specialist finance is needed as you are closing one income entity and establishing a new trading ABN and entity. Consequently, you are unable to provide sufficient income evidence for other types of loans.

- Liquidation of a company. Such as business restructuring where overdrafts and business loans need closure or put under a new entity. Consequently, the short term income won’t fit the lending criteria of traditional lenders.

- Indeed, private loans can allow for partial payment or full payment of Tax debt.

- Importantly, avoid the complex lending policy for fast access to money.

- In sum, traditional lenders don’t like risk, such as legal proceedings. Consequently, business legal or court action is a suitable purpose.

- Finally, used for the payment of business debts such as supplier invoices, business overdrafts & business loans.

Private mortgage finance can be an effective method for obtaining fast business funds. At the same time, traditional lending can be a hindrance because of their tight policy guidelines. As such, private lender policies are more flexible than conventional loans.

However, 2nd mortgage loans need to be practicable for the businesses requirement and purpose. Therefore, you would have an excellent chance of approval if:

- Firstly, you have good equity in your property.

- Secondly, your property is acceptable for the lender.

- Thirdly, you will need an exit strategy and how you will be paying the loan back.

- Finally, the purpose of funds is for business use.

Second mortgage loans are a popular type of lending for business. As such, second mortgages have great benefits for businesses requiring fast access to funds. However, private mortgage loan funds are usually short term loans. Consequently, you would need to have thought about how to pay back the funds within the loan term, or at the end of the loan term.

Second mortgage loan terms are commonly between 1-12months so are usually repaid from the sale of an asset or a loan refinance.

Tax Debt FAQs

As of September 2023, the tax debt owed to the Australian Taxation Office (ATO) stands at approximately $50.2 billion. However, small business collectible tax debt accounts for approximatley $33 billion of that total. Notably, the ATO’s collectible debt has increased from $12 billion in the 2019/2020 year. This growth in debt owed to the ATO can be attributed to two significant factors:

- Businesses Falling Behind During COVID Lockdowns: Many businesses faced financial challenges during pandemic-related lockdowns, impacting their ability to meet tax commitments.

- ATO’s Temporary Hold on Tax Collection Activities: In response to the pandemic, the ATO temporarily suspended some tax collection activities, which contributed to the accumulation of debt.

Generally, no. The Australian Taxation Office (ATO) typically applies any refunds directly to your tax account to offset the outstanding tax debt balance.

The ATO guidelines for releasing tax debt are related to the type of tax debt and your situation. As such, in certain cases, you may be able to be released from the tax debt however you need to show serious hardship if you were to pay the tax debt. However, the term serious hardship is a grey area without clear guidelines.

We have seen cases where clients are released entirely from tax debt, though it is infrequent. As a result, the most common result is a remission of the penalties and the general interest charge (GIC). However, the ATO will want to assess all financials and BAS lodgment up to the current date to allow them to understand your full tax obligation.

Types of tax debt eligible for release

- Initially, personal income tax.

- Also, PAYG income instalments.

- Medicare Levy.

- Finally, general interest and penalties associated with the tax debts.

To apply for a release of your debt as a result of tax debt hardship see the ATO application for release of tax debt.

Types of tax debt not eligible to be released

- GST

- Superannuation Guarantee Charge for employees

- Also, PAYG withholding tax for employees

In most cases, there is a mix of tax debts payable that can and cannot be released. As such, in most cases, you would require a mix of either release of tax debt, ato payment plans, or help with tax debt loans to pay out the tax debt entirely.

Contact us or seek professional advice to discuss your tax debt hardship finance options.

Tax Debt Negotiation can give you a tremendous financial advantage. However, there are a few conditions the ATO requires before approving any tax debt reduction.

- The ATO requires all of your Bas lodged and financials up to date. Indeed, the ATO wants to understand the full tax debt obligation due. For that reason, the ATO will want to know the entire tax obligation, including interest and penalties to the account.

- Consequently, this may not be practicable as there may be a pending business wind up, bankruptcy, or court case for the debt. Furthermore, it is essential to disclose any court matters or wind up to us. As such, this can assist us in determining if a tax debt negotiation is the best solution for you.

- Finally, tax debt is not usually fully waived. However, we have seen certain cases where it has been waived entirely. Consequently, waiving a debt has to meet very specific hardship and debt waiver policies.

ATO payment plans and negotiations are suitable when you have time and not when you are experiencing a severe tax debt hardship issues and pending insolvency action.

Navigating the ATO financial hardship policies is complex. Therefore, to gain hardship approval you will need sufficient supporting evidence for ATO approval. Furthermore, successful tax debt hardship applications can take anywhere from 14-60 days to be approved.

As a result; faster solutions such as caveat loans may be required to prevent legal action. However, if speed is not a critical factor; and you have time before legal proceedings then applying for hardship may still be a preferable option.

Certainly, if there is little or no time, or you have received a legal letter; then finance to pay the tax debt may be a more suitable solution.

Australian Tax Office Website: Policy guidelines for ATO Tax Debt Hardship

Yes the ATO can bankrupt individuals. However, businesses are wound up under an involuntary business wind up or liquidation. Certainly, someones financial situation can be investigated and understood under bankruptcy. Consequently, without a transparent disclosure of assets, it can be difficult to gain a full picture of the assets available to sell and pay a debt.

Therefore the bankruptcy trustee would have the power to seize assets allowed under the law. As a result, this includes freezing bank accounts and have the power to investigate your assets and what can be sold. In contrast, the ATO has no way of knowing if you are an individual with a large asset base hidden somewhere.

The ATO has several collection methods at their disposal for collection of ongoing and outstanding payments. As a result, you may encounter, or use the methods listed below.

ATO Automated Tax Collection

These methods are standard practices implemented by the ATO to simplify business compliance.

- Single Touch Payroll

- Equally, Electronic Lodgement of Superannuation (SGC)

Tax Debt Payment Plans

- Firstly, Payment Plans can be established with the ATO. However, not all payment terms offered can be anywhere from 18 months to 2-years to clear the ATO debt. Therefore, achieving a suitable payment may not be possible with such short payment terms. Furthermore, click here for more information on ATO Payment Plans and the benefits and risks for your business.

Debt Collectors

The debt is sent off to one of several debt collection agencies to recover the debt.

Finally, the ATO can lodge a second mortgage to secure their debt. Consequently, a second mortgage would allow the ATO to force the sale of your property in the event of a default. Indeed, a second mortgage would avoid the need to employ and pay a bankruptcy trustee to collect on the tax debt.

How does the ATO Force Debt Collection?

When a business doesn’t fit into the payment plan requirements of the ATO, then other collection methods are used. However, along with these collection methods is usually the closure of your business. Therefore, a payment plan or finance option is almost always the best solution.

- Firstly, Business Wind Up- the ATO can close your business because of a tax bill. As such, the ato can force a company liquidation to pay a tax debt.

- Indeed, ATO Bankruptcy – a personal bankruptcy gives a bankruptcy trustee the power to sell your assets to pay your ATO debt.

Other Debt Collection methods

- Not economical to pursue – The ATO can hide your debt from the portal view. Consequently, waiting until you gain an asset, they can sell. Similarly, you may become more profitable and garnish funds in your bank. For that reason, we feel the correct term would be “not economical to pursue now.”

The ATO has several mandates under their taxation provisions. As a result, if you don’t pay tax or manage your obligations:

- Firstly, the ATO sees your business as causing a non-competitive environment of trade and will close your business.

- Secondly, closing or winding up your business moves the revenue to a competitor. As a result, taxes start coming in from that business.

- Thirdly, the ATO removes your business it brings competition back into your market space. i.e. the new business charges appropriately for services with consideration to the tax payable.

- Finally, the sale of assets using Business Liquidation and director bankruptcy forces the recovery of lost taxes.

Of course, selling your products and services is paramount to every business. However, meeting your tax obligations is critical. As a result, we have seen the most common cause of forced business wind up is tax debt. Therefore, applying for tax debt hardship at an early stage is essential.

Many businesses use the ATO as an unofficial overdraft facility. In effect, they are accruing tax debt by allocating tax payments to pay business expenses or fund growth. Therefore, paying the ATO obligation once the business is trading profitably. However, the ATO is implementing changes to recover funds more quickly, causing issues with these businesses.

The ATO has higher expectations regarding resolving tax debt and how to manage tax portal accounts. In summary, the Australian Taxation Office won’t allow a business to keep inflating tax debts. As such, they are implementing strategies for collection of tax when due.

In brief, if you cannot prove your ability to pay your tax obligations, the ATO will seek:

- Indeed, full payment of the outstanding debt or;

- Secondly, the closure of your business.

- Finally, you may apply for financial hardship & debt relief. However, your application must meet ATO policy guidelines.

Yes, if your debt is under $100,000, it can be set up via automated phone prompts. Also, you can set up payment plans direct with the ATO or their debt collection company. We find, the payment plans are mostly between 12-18 months and do not (usually) exceed 24 months.

All ATO tax obligations such as BAS lodgements, financials, and superannuation obligations would need to be maintained; otherwise, the tax debt payment plans would be cancelled. If so, legal action would continue.

Applying for ato tax debt hardship with the ATO is quite an easy process. However, gaining an ATO hardship approval needs to fit within the ATO policies. Consequently, there are several ways to improve your chances of approval for Tax Debt Hardship:

- Call the ATO to discuss hardship and that you are unable to meet your obligations. Indeed, the ATO will make decisions based on their ATO hardship guidelines. Keep in mind, you will need to fully cover your circumstances and show financial difficulty. Also, the ato would seek a payment plan to cover the full tax debt account when determining suitability.

- Firstly, business closure.

- Secondly, disconnection of an essential service.

- Also, repossession of vehicle for business purpose. Imminent legal action pending for non-payment of debts.

- There are hardship review limitations. Such as, you cannot be approved hardship a substantial time after an event. Such as, you suffered an illness, and you applied for tax debt hardship two years after. As such, apply for the hardship the same specific financial year.

- Finally, You cannot access bank accounts because of court orders.

If you can’t pay your tax debt, there are several options:

- Firstly, Tax debt hardship application which includes payment plans with the ATO directly. However, you may also negotiate reductions with your ATO tax debt or general interest charge.

- Secondly, obtaining finance to pay your tax debt. As a result, this could include refinancing your home loan to consolidate your tax debt.

- Thirdly, Unsecured lending.

- Also available are 2nd mortgages and caveat loans.

There are several reasons a tax bill can occur, which we have found tend to fall into the categories below:

- Firstly, misunderstanding of your tax obligations. We see this is mostly the case with small businesses where the business owner didn’t understand all the taxes needed to be paid. Such as, misunderstanding of personal income tax, business income tax, GST, PAYG instalments and superannuation owed.

- Secondly, your business uses ATO payments for working capital.

- Indeed, illness or death in the family.

- Marital issues.

- Accountant issues.

- Bookkeeping issues.

- Finally, reduced business cashflow causing problems.

We have lenders who can go up to 90% LVR against your security property. However, some factors affect the LVR, such as:

- Firstly, the type of property and location; including the size of the land.

- Secondly, property zoning, such as rural or farm zoning can attract lower LVR’s.

- Thirdly, your credit history and if debts are paid or unpaid. Indeed, there are many other LVR affecting factors.

The LVR available is very important as the loan available against your property will determine if the tax bill can be fully paid. As a result, sufficient LVR and loan amount will enable the new loan to fully cover your circumstances.

The loan application process varies depending on the type of tax loan. However, here is an overview of the Loan Saver Network tax debt loans application process:

- Financial Assessment: We begin by discussing your financial situation and identifying suitable loan options. These options may include individual loans or a combination of business loans.

- Free Tax Loan Proposal: You’ll receive a free tax loan proposal, providing clarity on what you can achieve.

- Document Collection: We gather relevant documents related to your business, security property, tax debt, home loan, and other loan information.

- Loan Application Submission: Your loan application is submitted to the most competitive lender that aligns with your requirements.

- Documentation Completion: Once approved, we finalize the loan and mortgage documentation.

- Loan Settlement and ATO Payment: Following documentation completion, the loan settlement occurs, and payment is made to the Australian Taxation Office (ATO).

Remember that seeking professional advice and understanding the terms of your loan are important steps in managing your business and tax debt effectively. Contact Loan Saver Network on 1300 796 850 or Apply for Loan.

Borrowing to pay a tax debt is very much the same as traditional lending. However, there are some differences in policies because of the higher risk in loans for tax debt. As a result, the three main loan types suitable to pay for tax debt.

- Firstly, secured short term loans such as caveat loans and second mortgages.

- Long term loans similar to traditional finance.

- Unsecured Finance options, however, these can be very restrictive and unsuitable.

Caveat Loans

- Requires Minimal income verification

- Lower Loan Ratios

- Higher fees

- 24 hour – 2-week settlements.

Specialist tax debt home loans

- Income verification and servicing requirements

- However, there are low doc loan options available.

- Also, credit issues are acceptable and reflect the pricing.

Loan Saver Network can assess the type of loans most suitable for your purpose.

Yes, several short-term lenders offer business tax debt loans. They are also other business loans such as invoice factoring, and trade finance designed to provide working capital while continuing to trade.

However, the various other business tax debt loans include:

- Initially, caveat loans and second mortgages requiring real-estate security.

- Also, caveat loans requiring vehicle security.

- However, there are also invoice factoring facilities.

- Plus, pay tax debt or obtain working capital by obtaining unsecured business cash flow loans.

- Finally, supplier financing facilities.

We have helped many people obtain finance even when there is bad credit. Indeed, the various forms of bad credit include:

- Firstly, minor defaults such as telco, electricity and gas credit defaults with <$1000 value.

- Secondly, severe defaults such as defaults >$1000 value defaults.

- Thirdly, court judgements and writs such as from the Australian Tax Office.

- Finally, business wind-up orders such as creditor and ATO wind up proceedings.

However, specialist lenders do understand credit issues which means they don’t need to be a life long jail sentence.

Loan assessments use a diverse range of information. Mostly, information such as income, property equity, your type of property and your credit history. Consequently, lenders make approval decisions based on all this information, including your credit history. Hence, credit issues don’t immediately eliminate the chance of loan approval.

Traditional lender policy will not allow lending for tax debt purposes. However, there are private and specialised lenders able to assist.

- Firstly, unpaid tax debt in the ato tax portal will prevent traditional bank approval. Consequently, banks actively look for ATO issues by confirming ATO Portal balances.

- Secondly, a traditional lender will decline loans because of tax debt.

- Finally, specialised finance such as a tax debt loan can pay a tax debt.

Unsecured Business Loans FAQs

Unsecured small business loans are quite fast. As such, you usually have access to funds within three days to one week. However, it all depends on the complexity of your business and finance. Also, access to funds can be the next business day after approval, and within 24 hours.

Unsecured small business loans have a simpler application process and are much faster than bank lenders.

Unsecured facilities can be in the company name. As such, there is a need to tie up personal security in company borrowing.

Importantly, a loan facility in the directors’ names would require adjustments to personal and business financials.

- Accounting for a loan from you personally (director) to the company.

- PPSR from you personally to the company to protect your loan to the company. As such, a PPSR would protect you in the event of a company wind up.

These are additional work; however, help protect personal assets. Although secured facilities have other benefits; such as lower repayments and longer loan terms. However, unsecured facilities have different risks and benefits.

Finalise supplier invoices with supplier finance. Hence, spread your supplier terms from their immediate payment to 6 months. As such this can help improve your business cash flow. Additionally, you may obtain extra working capital funds for cashflow purposes.

Supplier Finance is mostly used for business expansion, putting on new staff or minor fit-outs. Also, are excellent facilities for new start-up businesses where there is little evidence of cashflow.

- Firstly, ongoing facility to suit business need.

- Secondly, no property security required. PPSR Business security required

- Thirdly, the loan facility in business or company name

- Also, loan amounts provided to 80% of your invoice (lender conditions apply). Then once the invoice is paid the remaining 20% is provided minus fees/interest costs.

- Then, some lenders will allow factoring of invoices on an ad hoc basis; without the need for financing all invoices.

- Finally, settlement for invoice fiance can be achieved in 2 – 7 days, depending on the lender

Invoice financing facilities provide finance against your unpaid invoices. Therefore, where invoices have 90-day terms, they can severely affect your business cash flow. Plus, we find business cashflow suffers further when there is a change in invoice terms from 30-day to 90-day terms. Therefore, the business struggles to fund a further 60 days before receiving revenue.